Major operators with freshly repurposed portfolios and sanctioned projects may soon begin looking to pounce on opportunities that would build up their long-term growth prospects.

“The majors have done a lot of work getting themselves in good shape at $50/bbl,” said Greig Aitken, Wood Mackenzie principal mergers and acquisitions (M&A) analyst, during a webcast on the topic. “As a result of that, they are looking generally pretty solid from a balance sheet perspective, and they have got pretty solid near-term growth outlooks. And, on that basis, the primary order of business should be normal portfolio management.

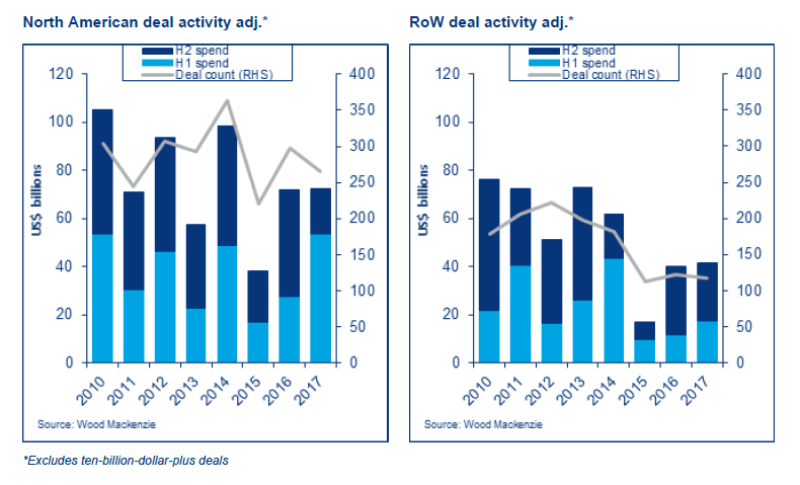

“But, with these strong balance sheets and improved cash generation, they have got the strength to target the longer end of production outlooks, so we can expect to continue seeing some larger acquisitions from these companies targeting the long end of production growth,” he said. Last year, the majors through M&A altogether spent $24 billion, the most since 2012 minus Shell’s takeover of BG Group in 2015.

The research and consulting firm believes majors will continue targeting opportunities offshore Brazil, where they have been drawn to new frontiers and high oil and gas volumes. Another priority could be increased exposure in US unconventional regions, where “corporate analysts always feel the majors should have an element of their portfolio for the flexibility that uncons can give you,” Aitken said.

Among the biggest European firms, Statoil could see more acquisition opportunities arise in Brazil after its recent multibillion-dollar Roncador deal alongside Petrobras, with which the Norwegian firm is participating in a strategic partnership. Total, which also has a presence in Brazil, could look for opportunities to sustain long-term growth, especially given its emphasis on a gas-weighted portfolio.

Another major focusing on gas, BP has recently been active in sanctioning projects globally and will need to renew its queue of possible developments, Wood Mackenzie said.

US major Chevron, meanwhile, has seen improved cash flow following the startups of the Gorgon and Wheatstone LNG projects in Australia, providing incoming Chief Executive Officer Mike Wirth a solid business development template from which to work.

National oil companies (NOCs) have nowhere to go but up after a mum 2017 in which they spent less than $2 billion on deals. Those reportedly looking for deals this year include India’s ONGC and Thailand’s PTT Exploration and Production with their “big growth targets and reasonable financial capacity,” Aitken said.

Chinese NOCs, which a few years ago were among the most active in M&A, “have structural production declines to tackle, and they do have the financial capacity to do this. So they might get back into M&A to some extent, but actually we think they’ll primarily look toward discovered resource opportunities,” he said.

Those companies’ recent absence relates to the perception that their flurry of previous deals provided poor, lower-than-expected value. If they do reengage in M&A, Wood Mackenzie believes they can avoid repeating those mistakes by reducing deal sizes, seeking preemptions and stake consolidations in existing assets, and buying into assets alongside established firms including majors.

Among the Russian firms, Rosneft will continue to look toward the Middle East and North Africa for expansion.

Wood Mackenzie in December said it expects a slight rise in overall global upstream spending in 2018 to $400 billion, reflecting a 15% increase in spending for both unconventional and deepwater projects compared with 2017 levels.

US, Europe Activity Won’t be Like 2017

Influenced by equity markets, US unconventional producers in the second half of 2017 focused on cash flow and living within their means instead of growth, and more of the same is expected this year. During the first quarter of last year alone, $21 billion targeted tight oil and almost $17 billion was spread across the Permian.

Wood Mackenzie notes the bid-ask spread among US deals has widened slightly due to variability around modelling assumptions such as cost inflation, spacing, and discount rates. Despite higher spot prices, it expects valuations to continue pricing deals around $65/bbl long-term.

However, the consultancy expects US deals to include an increasing number of contingencies, which have been more common internationally to bridge the bid-ask spread by derisking variables such as future oil and gas prices, exploration success, production growth, and development progress.

For deals that do take place, Wood Mackenzie expects to see continued disposals of noncore acreage. Moves to consolidate companies or acreage in existing core regions may be given the greenlight if those deals improve efficiency and reduce costs. Asset purchases would have to occur on a broadly cash-neutral basis either through swaps or funding purchases with offsetting divestments.

Whether the US M&A market remains subdued could depend on whether oil prices stay in their current range over the next few months, Aitken said. If prices remain high, companies could be pushed to grow again. Meanwhile, if the public equity markets in North America “aren’t going to provide adequate capital to companies, you can be sure that private equity will see an opportunity to step in and bring value forward,” Aitken predicted.

“There is still a lot of private equity money out there looking for a home,” he said. Europe also experienced strong M&A growth last year, much of which, like in the US, was fueled by private equity. However, he expects less private equity activity in Europe this year because fewer assets are available after last year’s movement. “And some of the big PE companies that we knew had money to spend have now spent that.

“But there are still more PE companies out there looking to do a deal,” Aitken added. “Some of the companies which have already dealt may look to do bolt-on acquisitions as well, so they’re still going to be there this year.”